duurzaamheid

Robur Capital ESG Policy

In recent years, the global business landscape witnesses a paradigm shift, with an increasing recognition that financial success should not come at the expense of environmental and social considerations. Private equity, as a cornerstone of the financial industry, has to embrace this transformation, recognizing the crucial role of Environmental, Social and Governance factors in shaping long-term value and sustainability.

That’s why at Robur Capital, we strongly believe in the significance of responsible investing to create enduring value and contribute to a sustainable future for our clients and the global community. As our commitment to sustainable growth extends beyond financial gains, we prioritize integrating ESG considerations into our investment process. The Robur Capital ESG policy articulates our dedication to sustainability and details how we contribute to the shift toward a sustainable economy from our position as evergreen investment company.

E

ESG in the investment business begins with a commitment to environmental responsibility. Portfolio companies are increasingly aware of the impact their investments can have on the planet, and they are integrating environmentally sustainable practices into their decision-making processes. By evaluating the environmental footprint of potential investments, Robur Capital can not only mitigate risks associated with climate change but also capitalize on opportunities presented by the growing demand for sustainable solutions.

S

The “S” in ESG emphasizes the social dimension of investments. We are recognizing the direct impact we can have on an the importance of fostering positive social outcomes. This includes considerations for employee well-being, diversity and inclusion, and community engagement. Investments that contribute to social progress not only align with ethical principles but also enhance the reputation of Robur Capital as an investment firm, fostering stronger relationships with stakeholders.

G

Effective governance is fundamental to the success of any business, and private equity is no exception. The “G” in ESG underscores the significance of strong governance structures. By promoting transparency, accountability, and ethical practices within portfolio companies, Robur Capital can ensure the sustainable growth of their investments. Robust governance frameworks not only protect investors but also contribute to the overall stability and resilience of the businesses in which we invest.

Integrating ESG considerations into our investment practices is not just about social responsibility—it’s about mitigating risks and creating long-term value. Investments that factor in ESG criteria are better positioned to navigate regulatory changes, adapt to evolving consumer preferences, and withstand market fluctuations. By identifying and addressing ESG risks early on, Robur Capital can enhance the flexibility and longevity of her portfolio companies.

Timeline – Value creation

through integration of

ESG factors

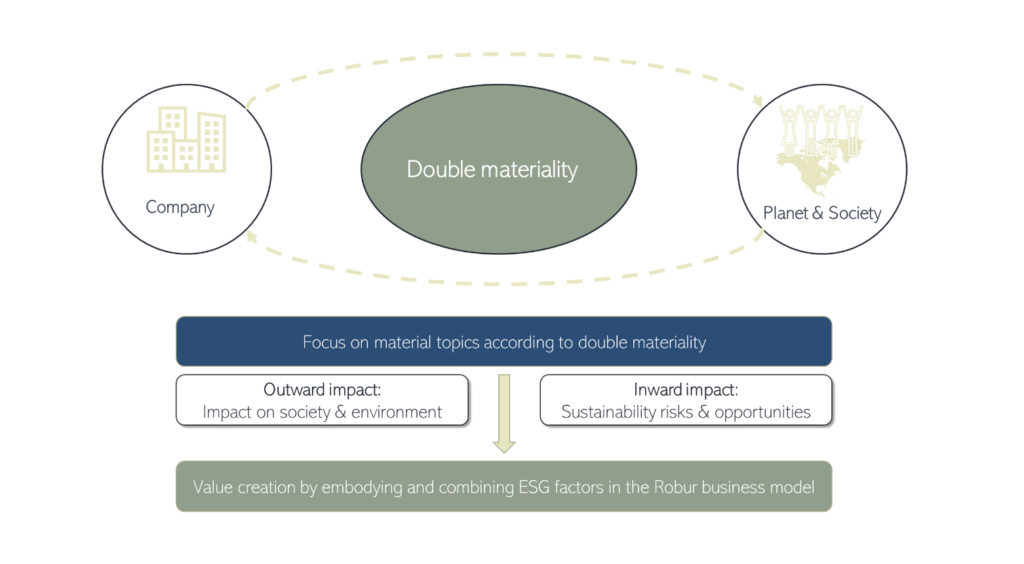

Robur Capital incorporates ESG into its investment processes and decision-making by evaluating both ESG risks and opportunities. Utilizing the double materiality principle, we assess how environmental factors impact businesses and, conversely, how businesses affect their environment. Next, Robur Capital aims to identify and prioritize relevant material topics in collaboration with its business partners. Rather than limiting itself to sustainable companies, Robur Capital supports the transformation of businesses in sectors confronting specific ESG challenges. Additionally, we seek to actively engage in various sectors that contribute to environmental and social modern unfolding.

Robur Capital carefully monitors its value creation, finding affirmation that its performance aligns seamlessly with the defined ESG policy. The assessment is based on the growth of shareholders’ equity, which includes dividends, over an internal defined period, reflecting Robur’s commitment to a long-term perspective throughout economic cycles. Moreover, we aim to maintain a healthy cash position and actively monitor the credit lines from longstanding banking partners. This financial strength provides us with ample resources to invest in existing holdings, fostering their growth, and exploring opportunities in new, promising, sustainable, and innovative ventures.

Timeline - ESG strategy roadmap

In order to ensure our business remains resilient for the future, it is now imperative to formalize investment objectives and implement a comprehensive sustainability strategy. To embark on this journey, we have already taken significant strides. In 2023, we performed extensive research and conducted several internship projects with focus on ESG. With the goal of arriving at clear results of our projects we had to diligently assess existing ESG initiatives, identifying areas for improvement, navigating the complex legal landscape surrounding sustainability obligations, and laying the groundwork for the integration of an ESG strategy. Moreover, devising a methodology to evaluate the ESG readiness of (potential) portfolio companies was key.

To position ourselves as a forward-looking enterprise, a strategic plan and timeline are essential to guide our future endeavors. Consequently, we have outlined the following initiatives in our Robur Capital ESG roadmap:

Responsible, sustainable investment policy

Robur Capital ensures that its portfolio composition aligns with long-term challenges through a comprehensive evaluation process. This involves examining investments based on the following criteria:

– Whether the company operates in a sector not aligned with Robur Capital’s investment preferences (exclusion policy).

– Whether the company operates in sensitive sectors and its performance on relevant ESG aspects or whether the company operates in a sector that could potentially positively impact ESG challenges (ESG screening and integrity policy).

The integration of ESG considerations occurs at every stage of the investment cycle based on the UN PRI framework. ESG aspects are factored into the assessment of investment opportunities. The outcomes of the ESG screening are discussed with the management and integrated into an action plan. Robur Capital aims for a best-in-class position within its sectors of operation. While each company defines its own ESG policy, Robur Capital acts as a partner, offering proactive input on significant ESG challenges for the company and its sector. The specifics are determined for each company based on sector-relevant standards, indices, or benchmarks. This analysis may also result in divestments from companies.

The overview below summarizes our responsible investment policy with a view to creating value:

1. Pre- acquisition phase

- Initial ESG assessment resulting in risks and opportunities

- No certain minimum ESG-score required

- Exclusion policy

- Arms: main activities in controversial and nuclear weapons

- Pornography: pornography, porn media, sex industry and prostitution

- Narcotics: production of narcotic drugs unless for medical purpose

- OFAC sanctioned countries : countries where trading or doing business is not allowed

- Child labor

- ESG research around potential participation

- Integrity policy including Robur’s key values and ethical standards

- Common laws and regulations

2. Acquisition phase

- ESG due diligence (topics: climate change, energy consumption, use of raw materials, pollution, ecosystems, value chain analysis..)

- ESG training

- ESG actions to anticipate risks and respond to opportunities

3. Acquisition phase

- Development of ESG strategies (actions plans, KPIs, reporting requirements..)

- Guidance & support

- Help to set out materiality analyses

- ESG innovation

- Discuss policies every year

- Best practice exchanges and workshops

- Reporting according to Robur templates

4. Exit phase

- Thorough research on ESG relevance for potential buyers

- ESG policy documentation in data room

- Use ESG as value creation lever